EURUSD on a 4-hour chart. Find Out What Services a Dedicated Financial Advisor Offers.

Howto Trade Chart Patterns Rounding Bottom Reversal Trading Systems 3 December 2014 Traders Blogs

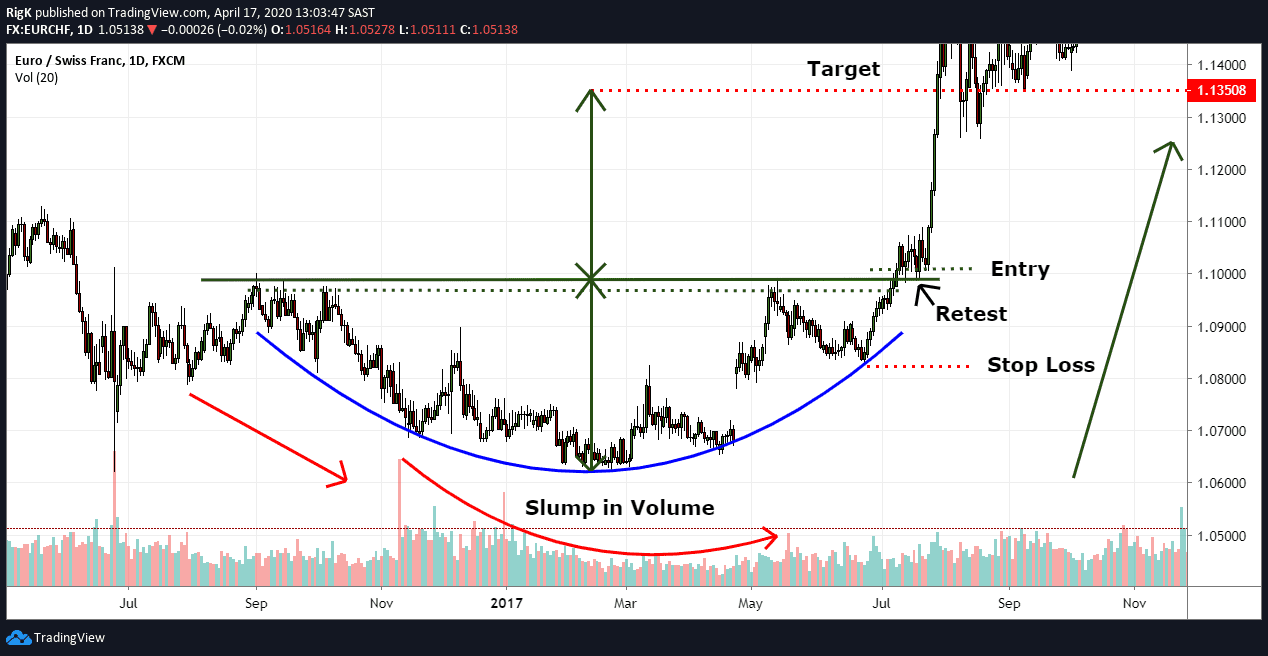

You may see a bearish bias convert into a bullish bias over a long consolidation period.

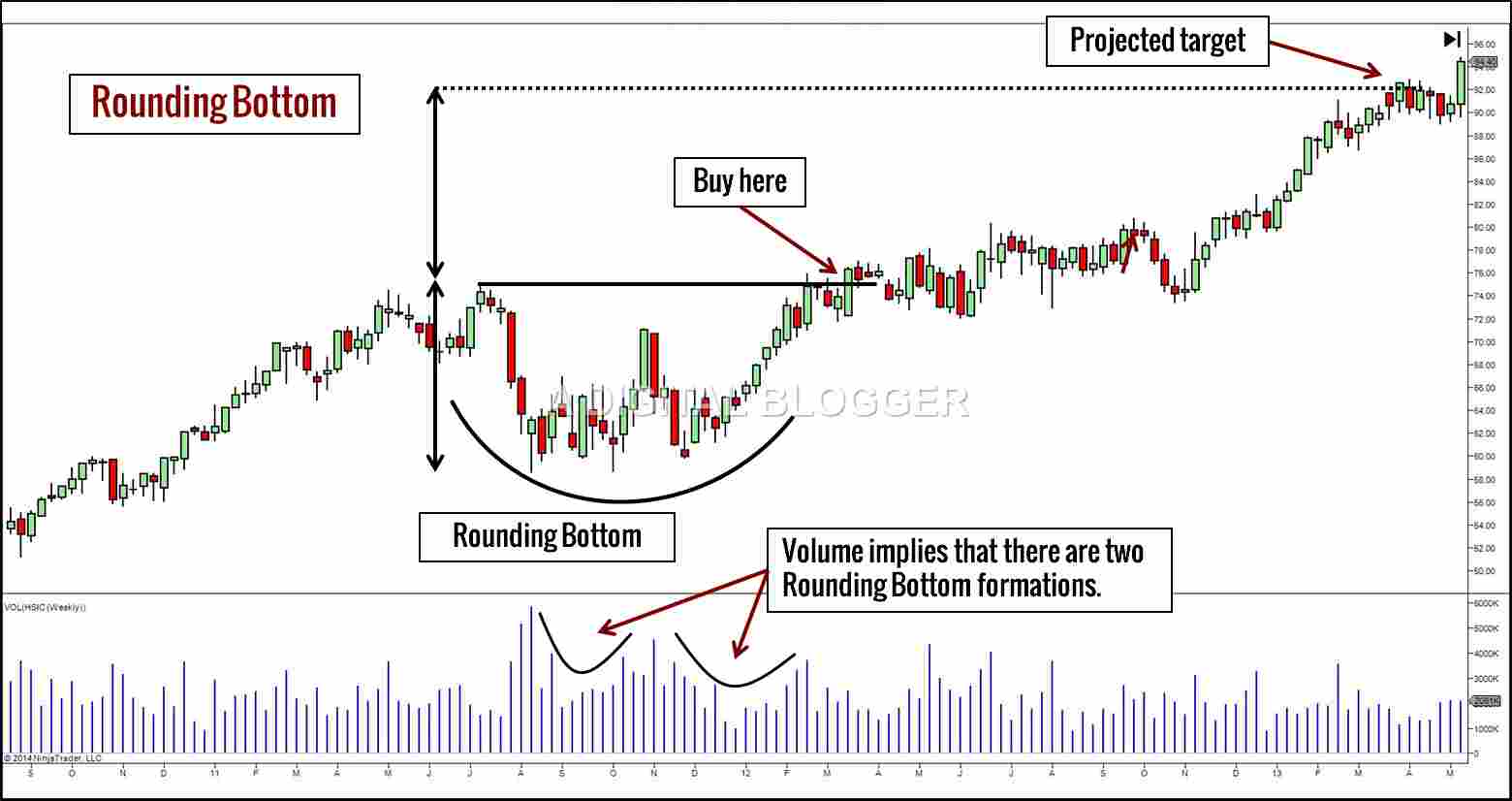

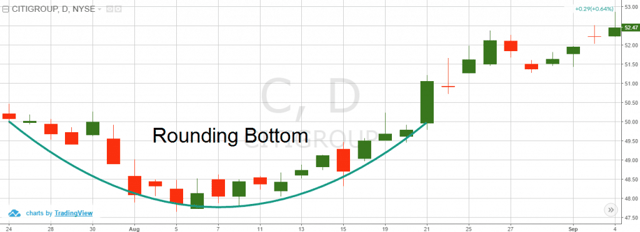

. This pattern is considered complete once price finally breaks and closes above the neckline. The pattern is confirmed when the price breaks out above its moving average. Rounded Bottoms are elongated and U-shaped and are sometimes referred to as rounding turns bowls or saucers.

Rounded Bottom Breakout Pattern The chart needs to be a downtrend and the longer the downtrend the better. Ad Build Your Portfolio Your Way. The pattern is confirmed when the price breaks out above its moving average.

A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. Rounding bottom pattern shows long-term reversal and is more suitable for weekly charts. First level support and resistance.

Traders may sometimes call it the saucer bottom pattern. Ad Savings Plans Can Be Overwhelming. First resistance r1 2 x pp low first support s1 2 x pp high.

The rounding top pattern is used in technical analysis to signal the potential end of an uptrend and consists of a rounded top sometimes referred to as an inverse saucer and a neckline support level where price failed to break through on numerous occasions. This chart pattern is considered complete once price finally breaks. Buy stocks based on rainbow - Monthly rainbow scan.

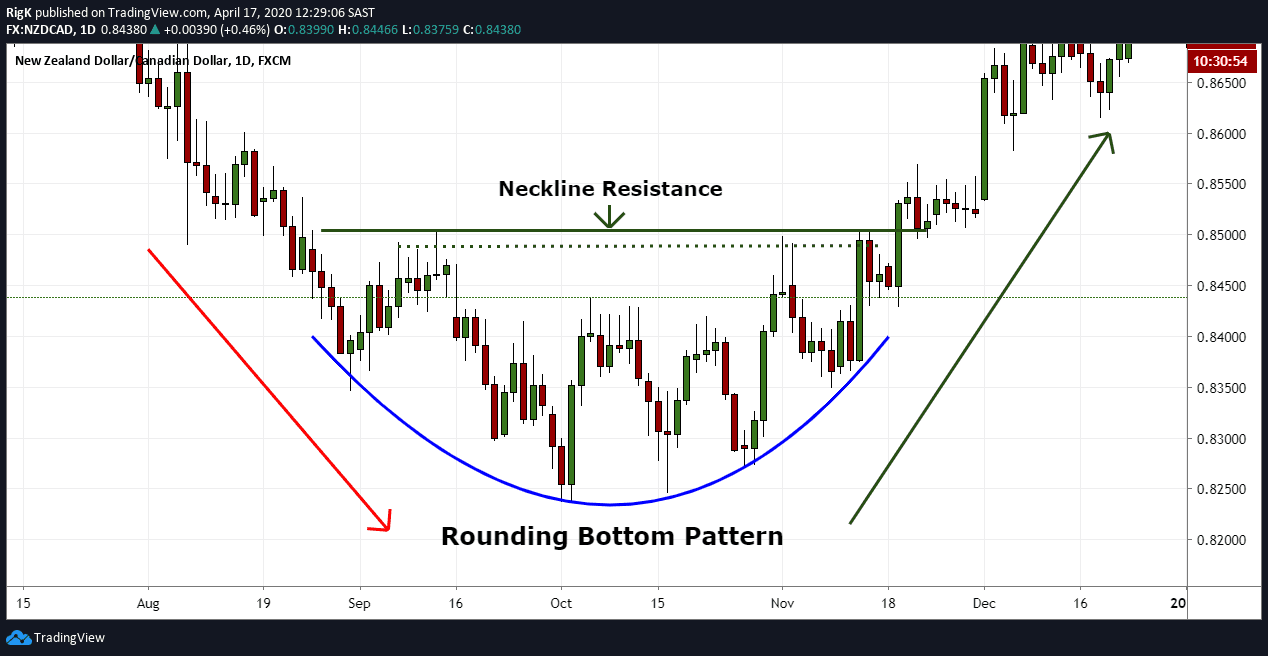

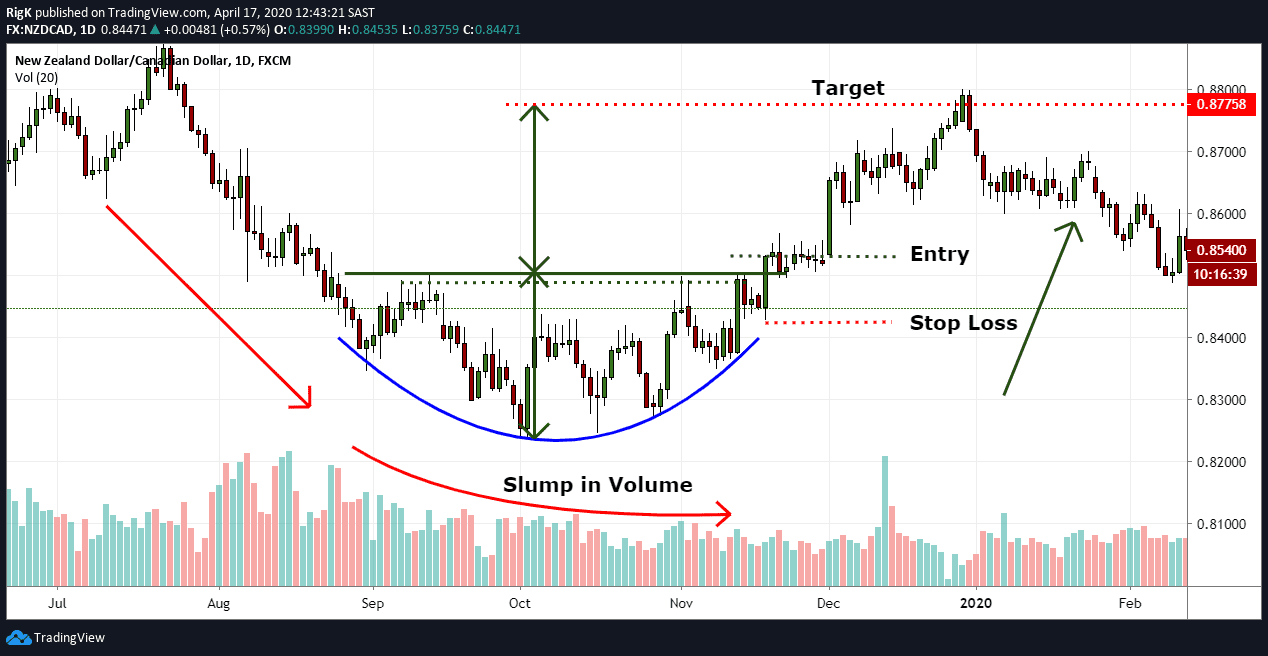

The rounding bottom pattern is used in technical analysis to signal the potential end of a downtrend and consists of a rounded bottom-like shape with a neckline resistance level where price failed to break through on numerous occasions. Monthly closing price is higher than last 20 months close. Monthly scanner - refined 1 - Monthly close or emas crossing above 3050100200 monthly emas for current or within a 5 months period.

Monthly closing price is crossing above monthly. The actual trigger is. It describes the drop of a stock or index.

NEW YORK -- One of my favorite chart patterns is called the rounded bottom breakout pattern. 2 Rounded Bottom Neck Line. The rounding bottom is a reversal chart pattern which develops after a price decline.

A Rounded Bottom is considered a bullish signal indicating a possible reversal of the current downtrend to a new uptrend. The weekly chart is most suited for the rounding bottom pattern as it has a longer consolidation period. Pivot point-without restriction-5 min-monthly - Pivot point pp high low close 3 support and resistance levels are then calculated off the pivot point like so.

There are hundreds of stock chart patterns But traders tend to gravitate toward a handful of stock chart patterns. A rounding bottom is a chart pattern used in technical analysis that is identified by a series of price movements that graphically form the shape of a U. There should be a bottom formed such that the chart is trading sideways forms a double bottom and has clearly reached.

Learn About Our Financial Advisor Services. A rounded bottom or saucer pattern is not a common pattern but is highly reliable as a reversal pattern with bullish implications. Choose Investments Using 0 Online Stock and ETF Trades.

The 20-day SMA is below the 34-day EMA. The rounding bottom is typically followed by a reversal upward in. How do we identify a rounded bottom pattern.

Rounding Bottom Reversal Chart Pattern Youtube

The Rounding Bottom Pattern Definition Examples 2022

Rounding Bottom Pattern Step By Step Guide To Use Rounding Bottom

The Rounding Bottom Pattern Definition Examples 2022

Step By Step Guide To Trade The Rounding Bottom Pattern Tradingsim

:max_bytes(150000):strip_icc()/RoundingBottom2-0a1514186d454d4b9e4fba32aed39f24.png)

0 comments

Post a Comment